BEIJING, May 4 (Xinhua) -- Foreign investors began trade in domestic iron ore futures on the Dalian Commodity Exchange (DCE) Friday, another step in the country's financial opening-up push.

The move comes after the launch of crude oil futures in March, the first futures contracts listed on the Chinese mainland open to overseas investors.

Iron ore contracts were launched in 2013 and broadly traded among producers and traders, with the futures prices closely correlated to spot prices. As of Thursday, 21 overseas companies had opened accounts with Jinrui futures, a domestic brokerage.

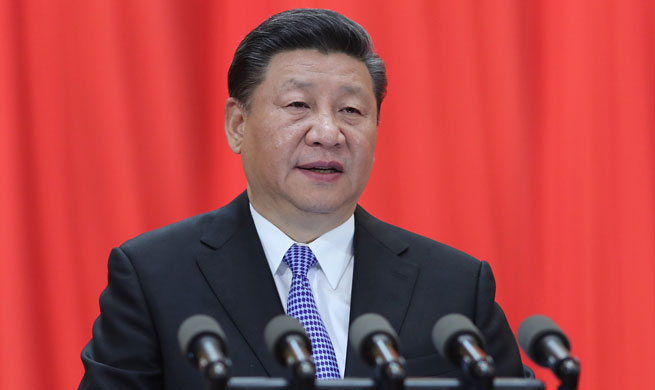

By including overseas investors in the trading, futures prices should better reflect the global iron ore market, according to Li Zhengqiang, president of the DCE.

"Global companies on the supply chain mitigate price volatility by locking into prices through futures contracts. This could help industrial upgrades," Li said.

China imports more than 1 billion tonnes of iron ore annually. As such a large importer, China has a responsibility to provide transparent iron ore futures prices, Li said.

The internationalization of crude oil and iron ore futures are important steps in opening up China's commodity futures market. The introduction of overseas investors brings challenges to regulators and exchanges, which will improve mechanisms and management, said Li.